A practical roadmap to starting your journey with Quantrust and smart digital tools

Have you ever felt like the stock market is just a giant puzzle meant only for the big players in South Mumbai or Gurgaon? Actually, most of us feel that way when we see the fast-moving numbers on the news. But things are changing quickly, and the Quantrust trading platform is becoming a popular starting point for regular people who want a piece of the action. Whether you are a young professional in Hyderabad or someone running a small business in Punjab, the goal is always the same: you want your hard-earned money to do more than just sit in a bank account. This guide is not about get-rich-quick schemes; it is a simple, step-by-step look at how you can use modern technology to your advantage in 2026.

Getting your mindset ready before you touch any buttons

Before you even think about downloading an app or looking for a Quantrust review 2026, the most important thing is to have a clear plan. Many people jump into trading because they saw a flashy video on social media, but that is the fastest way to lose your savings. You need to decide how much you are willing to set aside—money that you don’t need for next month’s rent or school fees. Simple as it sounds, starting small is the smartest move anyone can make.

Once you have your budget, you should spend some time learning about the Quantrust global trading firm and how they handle different markets. Understanding that the market goes up and down is part of the process. If you go in expecting a straight line to the top, you will be disappointed. The idea is to think long-term, just like how we think when we buy property or gold for the family. It is about patience and using the right tools to manage the risks along the way.

Setting up your space in the Quantrust algorithmic trading platform

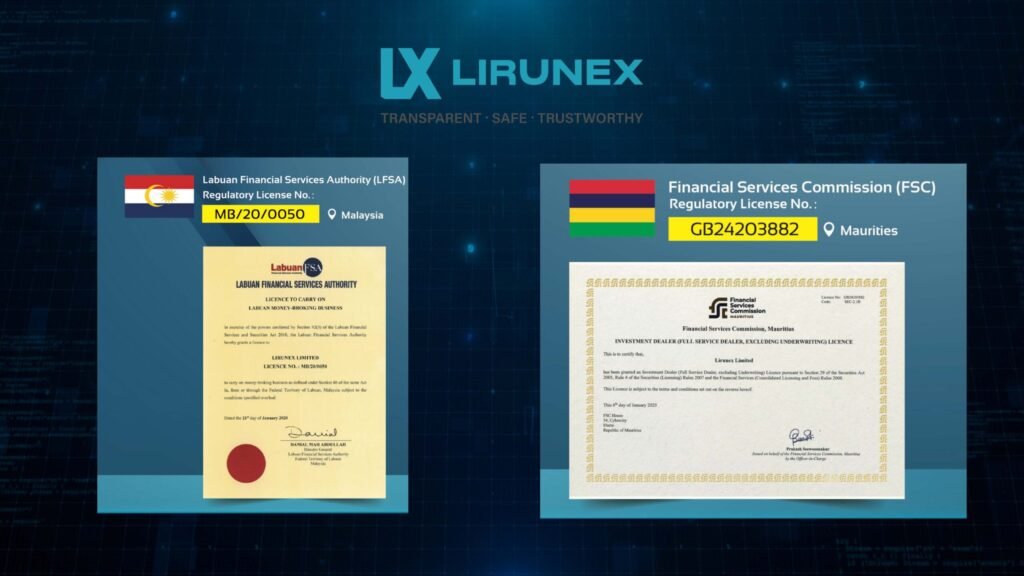

The actual setup process is much easier than it used to be five years ago. When you first enter the Quantrust algorithmic trading platform, you aren’t just thrown into a room full of shouting traders. Instead, you are looking at a clean interface designed for the modern user. Your first step is usually to verify your identity, which is a good sign because it shows the platform cares about security and following the rules.

After your account is ready, you get to choose how involved you want to be. Some people like to pick every trade themselves, but more and more locals are leaning toward the Quantrust AI trading company features. This is where the machine does the scanning for you. To help you decide which path fits your personality better, I have put together a simple table that compares the two main ways people use the system today.

| Trading Style | How it Works | Best For… |

|---|---|---|

| Manual Mode | You decide every buy and sell. | People with lots of free time. |

| AI Assisted | The system suggests trades for you. | Busy professionals and beginners. |

| Fully Automated | The bot executes trades 24/5. | Long-term wealth building. |

Choosing your focus with Quantrust forex and gold trading 2026

In the Indian context, gold has always been the king of investments. That is why Quantrust forex and gold trading 2026 is such a hot topic. Gold is something we understand; it feels real. When you use a Quantrust professional trading system, you are essentially trading the price movements of gold without having to worry about storing physical bars in a safe at home. It is cleaner, faster, and much more liquid, meaning you can get your money out whenever you need it.

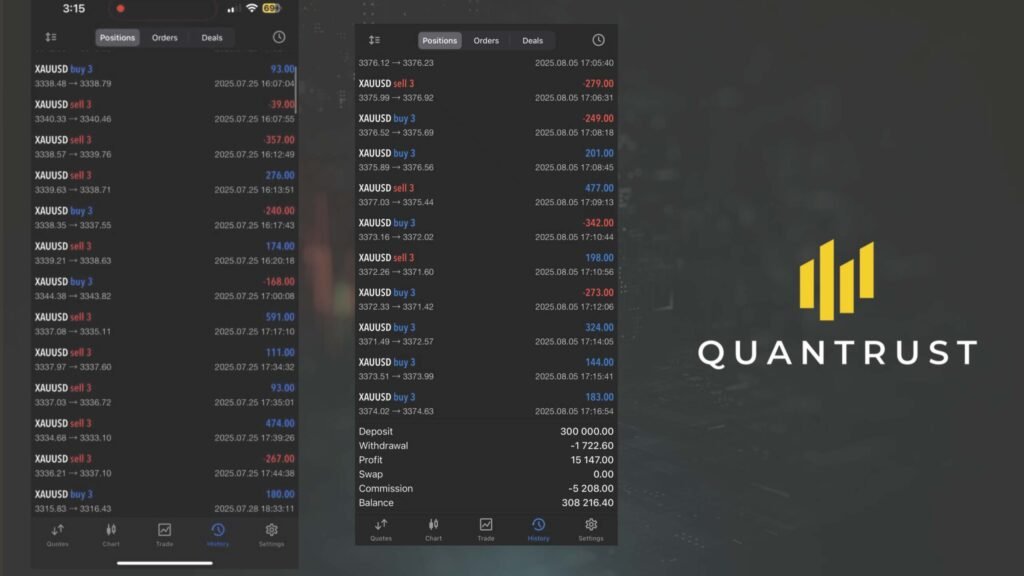

So, the next step in your journey is selecting your strategy. Most people start with a conservative approach. You don’t need to use high leverage or take big risks right away. Actually, the most successful people are those who focus on Quantrust long term trading performance rather than trying to double their money in a week. By picking a steady strategy that focuses on small, consistent gains, you are building a much stronger foundation for your future.

Managing your daily life while the system works for you

One of the best things about this new era is that you don’t have to be glued to your screen. After you have set your preferences in the Quantrust client portfolio management section, the tech takes over. You can go to your office, enjoy a Sunday brunch with your family, or even travel, while the system monitors the markets. It is a huge relief for those of us who find the technical charts too stressful to look at for hours on end.

In this context, a professional platform like Quantrust usually plays a more neutral, administrative, or supportive role. They handle the execution, the record-keeping, and the technical stability of the environment. You are still the one in control of your funds and your overall goals. It is a partnership where the technology does the boring, repetitive work and you make the high-level decisions about your life.

Staying secure and trusting the local infrastructure

As you get more comfortable with the digital world, you will realize that security is a team effort. While you use a global tool like Quantrust, you also need to make sure your local setup is solid. This is where names like Filken come into the picture, providing the kind of reliable local support and business infrastructure that keeps everything running smoothly behind the scenes. When your local connections and your global trading tools work together, you get the best of both worlds.

Final check on your Quantrust journey and goals

To wrap things up, remember that the world of finance is a marathon, not a sprint. Keep checking your progress every month and don’t be afraid to adjust your settings as you learn more. Using the Quantrust system is a great way to modernize your portfolio, but your own common sense is still your best asset. Stay curious, keep reading, and talk to others in the community to see what is working for them. With the right tools and a bit of patience, the digital market can become a very helpful part of your financial life.

Website :quantrustfx.com

Why are so many people choosing the PAMM model?

Q1: What does PAMM actually stand for?

It stands for Percentage Allocation Management Module. Simply put, it allows a professional manager to trade on your behalf, and the profits are shared based on the size of your investment.

Q2: Is my money safe in a PAMM account?

Actually, you do not have to sign complicated contracts, and the system is very transparent. You can see the trading activity, which makes it one of the most reliable ways to copy trades from pros.

Q3: How is the performance fee calculated?

The fund manager only takes a percentage of the profits they generate for you. If there is no profit, there is usually no performance fee, which keeps the goals of the manager and investor aligned.

Q4: Can I withdraw my money whenever I want?

Simple as it sounds, most PAMM systems allow for high liquidity. You generally have the freedom to withdraw your funds according to the terms set by the platform and the manager.

Q5: Is this suitable for someone with zero trading knowledge?

Absolutely. Many people in India use this because it requires no manual work. You just choose a reliable platform like Quantrust and let the automated professional system do the rest.